(Editor’s note: This has nothing to do with cryptocurrency but I wanted to draw your attention to the corrupt and criminal SEC (mentioned below). After my money manager was charged with (allegedly) spending our investments on himself, the SEC (San Francisco) contacted me and said we should get our initial investment back as it appeared there was money left. Well, they lied. I had to fight just to get $3,000 back . The SEC is one of the most fraudulent, corrupt organizations I’ve ever dealt with as a victim (or at all). They make the mob look like good guys. Trust me. Now onto the article.)

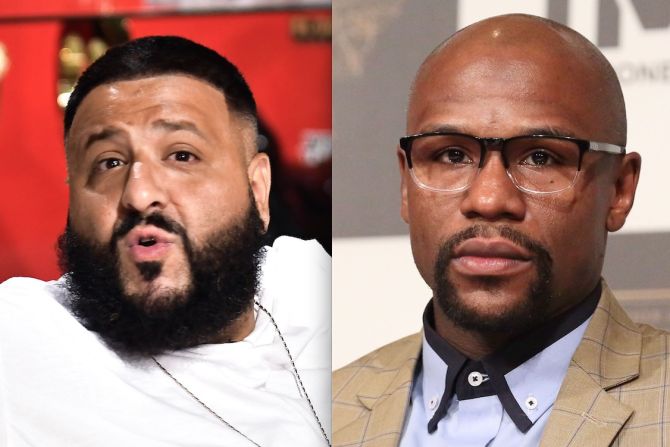

On Thursday, Music producer DJ Khaled and boxer Floyd Mayweather Jr. were charged by the Securities and Exchange Commission (SEC) with promoting investments in initial cryptocurrency coin offerings without revealing that they’d been paid. (FYI: according to the SEC, cryptocurrency coins sold in initial coin offerings may be considered securities and subject to federal securities laws.)

“Mayweather failed to disclose that he’d received $300,000 from three different ICO issuers, including $100,000 from Centra Tech. Khaled failed to disclose a payment of $50,000 from the same company.

Both Mayweather and Khaled promoted Centra’s ICO on their social media accounts. Khaled called it a ‘game changer’ while Mayweather encouraged his followers to get in on the ICO, saying he’d taken part. Mayweather also commented on another ICO, saying he was going to make a lot of money.”1

The SEC has made it clear that ICOs can be fraudulent and therefore encourages potential investors to be careful- or avoid altogether- ICOs that are endorsed by celebrities. (Centra was charged by the SEC for allegedly having a fraudulent ICO.)

Steven Peikin, the SEC’s enforcement division co-director said,

“With no disclosure about the payments, Mayweather and Khaled’s ICO promotions may have appeared to be unbiased, rather than paid endorsements. Social media influencers are often paid promoters, not investment professionals, and the securities they’re touting, regardless of whether they are issued using traditional certificates or on the blockchain, could be frauds,” said Steven Peikin, the SEC’s enforcement division co-director.”2

The pair settled with the SEC and agreed not to promote any securities, even digital ones, for two years and three years, respectively. They also agreed to give back the money they’d received to the SEC and pay penalties with interest. This is the first time the SEC has brought charges against individuals for promoting ICOs.3

The investigation is ongoing.

Source: